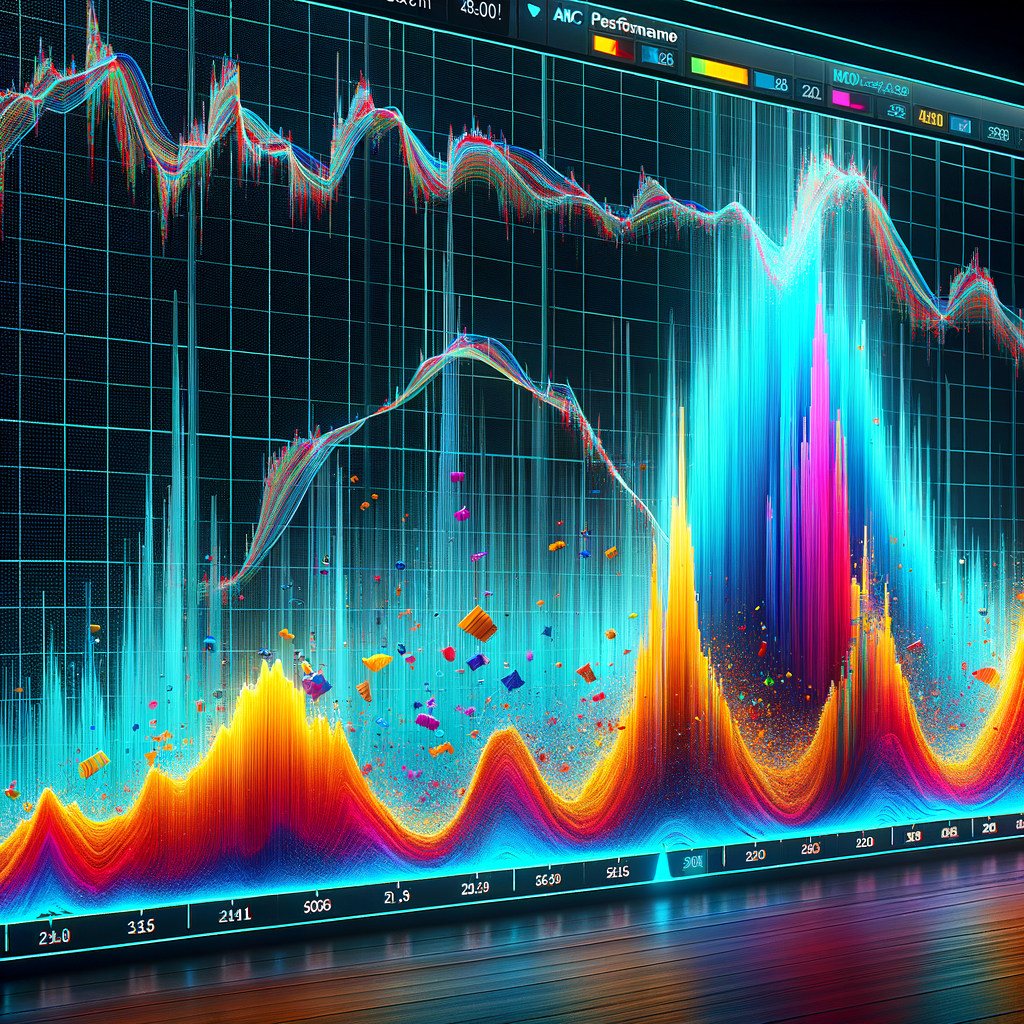

Analyzing AMC’s Stock Performance: Factors Behind the Three-Day Decline

AMC stock on track for third consecutive day of losses

In the ever-volatile world of the stock market, AMC Entertainment Holdings Inc. has recently found itself on a downward trajectory, with shares poised to close in the red for the third consecutive day. Despite this recent slump, there are several factors to consider that paint a broader picture of the company’s performance and future prospects.

The decline in AMC’s stock value can be attributed to a confluence of market forces and industry-specific challenges. Among these, the broader market sentiment has been cautious, with investors weighing the potential impact of rising interest rates and inflation on consumer discretionary spending. As a movie theater chain, AMC is particularly sensitive to shifts in consumer behavior, as its business model relies heavily on foot traffic and box office sales.

Moreover, the entertainment industry is still grappling with the aftereffects of the pandemic, which accelerated the shift towards streaming services and altered the traditional movie-going experience. This has led to a more competitive landscape, with streaming giants investing heavily in original content to capture audiences who now have more viewing options than ever before.

Despite these headwinds, there are reasons to remain optimistic about AMC’s prospects. The company has shown resilience and adaptability in the face of adversity. During the pandemic, AMC embraced new strategies to enhance its business model, including renegotiating lease agreements, reducing operational costs, and exploring alternative revenue streams such as private theater rentals and on-demand services.

Furthermore, the recent release slate suggests a resurgence in blockbuster films that could draw crowds back to theaters. Highly anticipated sequels and franchise installments have the potential to reignite box office sales, offering a much-needed boost to theater operators like AMC. The communal experience of watching a film on the big screen is a unique selling point that streaming services cannot fully replicate, suggesting that there is still an appetite for the traditional cinema experience.

Additionally, AMC has cultivated a loyal customer base, in part due to the unexpected rise of retail investors who rallied behind the stock during the meme stock phenomenon. This investor enthusiasm has provided the company with a more engaged and supportive shareholder community, which could play a role in stabilizing the stock price over time.

It’s also worth noting that the entertainment industry is cyclical, with ebbs and flows that correlate with seasonal trends and consumer habits. As such, the current dip in AMC’s stock may be a temporary setback rather than a long-term trend. The upcoming summer season, typically a strong period for movie theaters, could serve as a catalyst for recovery, with audiences seeking out the blockbuster experience during their leisure time.

In conclusion, while AMC’s stock may be experiencing a downturn, the company’s strategic initiatives and the inherent strengths of the cinema business model provide a foundation for cautious optimism. Investors and analysts alike will be watching closely to see how AMC navigates the challenges ahead, but with a slate of potential box office hits on the horizon and a dedicated base of supporters, there’s reason to believe that brighter days are ahead for the storied theater chain. As the curtain rises on the next act of AMC’s journey, the stage is set for a potential rebound that could see the stock emerge from this three-day decline with renewed vigor.

The Impact of Market Trends on AMC Stock: Understanding the Consecutive Losses

AMC stock on track for third consecutive day of losses

The Impact of Market Trends on AMC Stock: Understanding the Consecutive Losses

In the ever-volatile world of the stock market, AMC Entertainment Holdings Inc. has been navigating a tumultuous period, with its shares poised for a third consecutive day of losses. Despite this downward trend, a closer look at the broader market dynamics and AMC’s strategic moves reveals a silver lining that suggests potential for a rebound.

The cinema giant, known for its expansive network of theaters across the globe, has been grappling with the aftereffects of the pandemic, which significantly altered consumer behavior and entertainment consumption. The initial surge in AMC’s stock, fueled by a cohort of retail investors banding together on social media platforms, has since given way to a more sobering assessment of the company’s financial health and future prospects.

However, it’s important to note that the current dip in AMC’s stock performance is not occurring in isolation. The broader market has been facing headwinds, with rising interest rates, inflation concerns, and geopolitical tensions contributing to investor apprehension. These macroeconomic factors have cast a shadow over various sectors, with entertainment stocks like AMC feeling the ripple effects.

Despite these challenges, AMC has not been passive in the face of adversity. The company has been actively adapting to the new entertainment landscape, investing in the enhancement of its theaters and exploring alternative revenue streams. From upgrading seating to offering immersive viewing experiences with cutting-edge technology, AMC is working to lure moviegoers back to the big screen.

Moreover, AMC’s foray into the world of digital assets, with plans to accept cryptocurrencies as payment and the exploration of non-fungible tokens (NFTs), signals a willingness to innovate and tap into new markets. These strategic initiatives demonstrate AMC’s commitment to staying relevant and competitive in an industry that is rapidly evolving.

Furthermore, the intrinsic value of the communal movie-going experience, which streaming services cannot replicate, continues to be a strong draw for consumers. As social distancing measures ease and the public yearns for shared experiences, AMC’s theaters stand ready to welcome back crowds eager for the magic of cinema.

Investors, while cautious, have reasons to remain optimistic about AMC’s ability to weather the current storm. The company’s leadership has shown resilience and a forward-thinking approach in navigating the post-pandemic era. With a loyal customer base and a brand synonymous with movie-going, AMC is well-positioned to capitalize on the rebounding entertainment industry.

In conclusion, while AMC’s stock may be on track for a third consecutive day of losses, the broader context paints a more nuanced picture. Market trends and external pressures are undoubtedly influencing the stock’s performance, but AMC’s proactive strategies and the enduring appeal of the cinematic experience provide a foundation for optimism. As the company continues to adapt and innovate, there is potential for AMC to emerge stronger and more resilient, ready to seize the opportunities of a recovering market. The current losses may be a setback, but for those with a long-term perspective, AMC’s story is far from over.